Why Shift Capital may be just what Kensington needs for community regeneration

The New Street Fight

The Director of Drexel'south Metro Finance Lab on how Shift Majuscule might help brand Kensington a model of the right type of individual investment

Sep. 20, 2019

The other night I re-watched Marshall Corry's 2005 documentary, Street Fight, about the 2002 Mayoral race in Newark, New Jersey, that pitted Cory Booker versus Sharpe James. I highly recommend this moving-picture show: You will get the full measure of Cory Booker not just as an infrequent leader but as an private accepted to battling long odds.

The title of the documentary prompted this commodity. At that place are other street fights underway in the United states between major forces: small business versus big box, owner-occupants versus absentee landlords and quality versus parasitic upper-case letter.

![]() Terminal week, I visited Northward Kensington, a neighborhood that has been the epicenter of the opioid crisis in the United States. The purpose of the visit, undertaken with shut colleagues from Accelerator for America, Blueprint Local and other similar-minded entities, was to explore Shift Uppercase'due south heady model for community regeneration.

Terminal week, I visited Northward Kensington, a neighborhood that has been the epicenter of the opioid crisis in the United States. The purpose of the visit, undertaken with shut colleagues from Accelerator for America, Blueprint Local and other similar-minded entities, was to explore Shift Uppercase'due south heady model for community regeneration.

Shift Upper-case letter is a social impact real estate business firm that has been buying upwardly former industrial spaces in the community and remaking them equally outposts for maker firms and artistic entrepreneurs.

They are now seeking to purchase a substantial portion of the Kensington commercial corridor and test the proposition of a neighborhood trust, to ensure that value appreciation tin can be captured and deployed past a community, in the service of the community.

Major market forces and big sources of private capital letter are undermining the fabric of thousands of city neighborhoods.

The work of Shift Capital is pathbreaking, imaginative and inspiring. Information technology is also uncovering a story that is barely covered by national or local media. Major market forces and large sources of individual capital are undermining the cloth of thousands of urban center neighborhoods. This street fight is existence waged on multiple fronts.

Big box versus small business

The Kensington Corridor is a proxy for once thriving commercial corridors throughout the United States. It is a walkable corridor located nether an elevated train with historic properties that still sport pocket-size businesses trying to survive.

Yet the major commercial action is several blocks abroad, forth Aramingo Avenue, a corridor divers by big box retail, large parking lots and no soul. These big box thoroughfares exist all over the country, enabled by public policy changes, large and small, going back decades. Can Kensington Corridor revive? Can we rewind the economic system? Shift Uppercase and organizations similar Streetlight Ventures believe so if we can place authentic businesses that come across local and larger demand and back up them with finance, operations and marketing.

Owner occupants versus absentee landlords

The run up to the 2008 housing crisis was driven by shoddy underwriting and fraudulent activity. A different phenomenon has been taking place since then. Investors, large and small have been ownership upward "distressed properties," creating a "slumlord economy."

Brian Murray, the CEO of Shift Capital letter, explained the challenge well in a recent LinkedIn piece: "Absentee landlords—outside investors with no interest in the community other than their ain short-term proceeds—are able to hide behind partnership structures that mask their identities, leaving tenants with few ways to speak upwards or fight back."

Fortunately, this phenomenon is get-go to get mainstream attention, equally in this recent commodity by Alana Semuels.

Quality versus parasitic capital

Opportunity Zones was described as a solution to communities that were disinvested and had not received market place capital for decades. The reality of big box and investor owners show that these communities, by contrast, have been the recipients of large volumes of individual investment, albeit the incorrect kind.

![]() What's lacking is quality capital that enables small entrepreneurs and developers to rejuvenate the places they call home. This desire for quality majuscule runs up against serious marketplace challenges.

What's lacking is quality capital that enables small entrepreneurs and developers to rejuvenate the places they call home. This desire for quality majuscule runs up against serious marketplace challenges.

As Murray explains: "In neighborhoods where the boilerplate home value is $50,000 (as in North Philadelphia or Baltimore), investors and developers find it nearly incommunicable to secure a loan big plenty to cover a quality renovation. Rather, the current financing arrangement requires developers to come out-of-pocket more than they would in wealthier neighborhoods—a risk few are inclined to take."

How do we win the Street Fight?

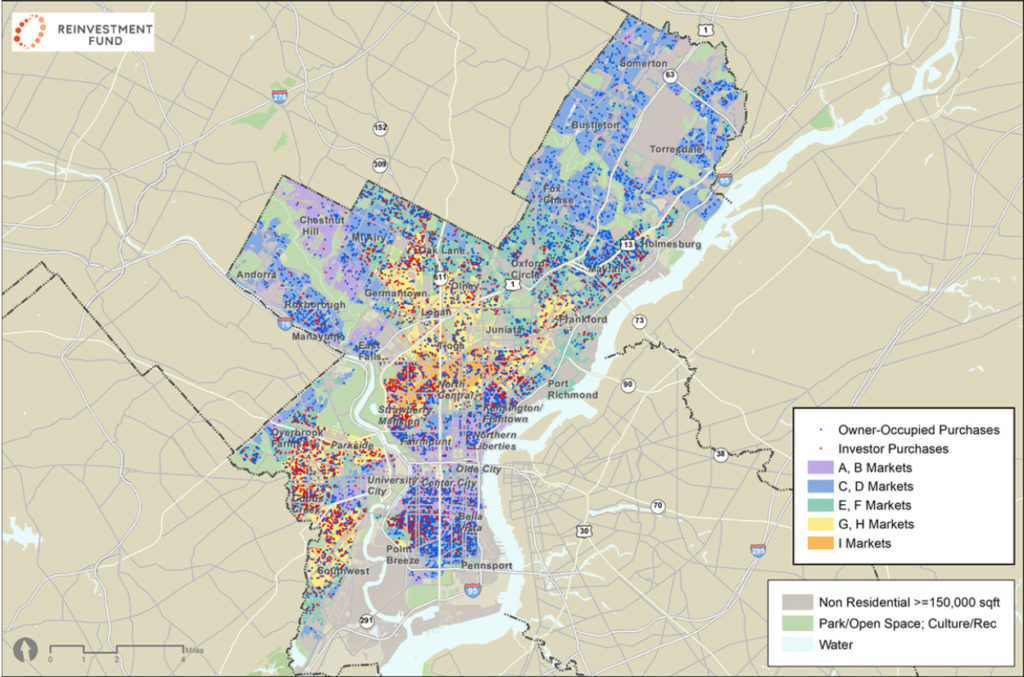

First, let's unveil the claiming. Ira Goldstein of The Reinvestment Fund has been painstakingly conducting Market Value Analyses for a growing number of cities. These analyses show the variance of marketplace strength across different typologies of urban center neighborhoods and particularly whether habitation purchases are beingness made by investors or by owners.

"Absentee landlords are able to hide behind partnership structures that mask their identities, leaving tenants with few ways to speak up or fight back," Murray says.

The Philadelphia map below shows the method. In general, the purple markets are very stiff, loftier-priced markets which are typically more renter-occupied than possessor-occupied; blue (very solid and highly owner-occupied); light-green (classic middle markets) and xanthous/orange (markets with stressors—e.g., foreclosures, vacancies, lower prices, piddling permitting or new construction).

Sales between 2022 and 2022 are represented past dots; blood-red for investors and bluish for owners. As you volition see, the xanthous and orange areas in Westward and Southwest Philadelphia, in improver to the area where Shift Capital is working, have lots of investor purchases.

Second, let's solve for specific problems. At that place are already tools in the tool box. Cities should use their foreclosure powers to acquire revenue enhancement delinquent properties more aggressively, which volition found the foundation for public asset ownership and creative disposition strategies.

Cities similar Tulsa, Oklahoma, are already using their zoning powers to exclude the lowest rung of big box retail, creating infinite for local businesses.

Philanthropies and governments should solve for the quality capital challenge by providing guarantees to traditional banks to lend on smaller deals. (I could list potential federal reforms, only I will get out that for another mean solar day). The list goes on and on and on. There are tools that already exist which need to be practical at scale.

Finally, let's test new mechanisms that build community wealth and organize new networks that advocate for them.

![]() The Neighborhood Trust, commencement explored in a piece by Joe Margulies—and other wealth building tools like the public nugget corporate model—deserve serious testing, lawyering, codifying and back up by philanthropies and governments.

The Neighborhood Trust, commencement explored in a piece by Joe Margulies—and other wealth building tools like the public nugget corporate model—deserve serious testing, lawyering, codifying and back up by philanthropies and governments.

At the same time, new networks of quality investors, entrepreneurs, developers, professionals, community organizations and churches tin can be formed to make these and other models the norm rather than the exception.

The U.s.a. faces a street fight of monumental proportions. It is winnable simply if we recognize and root out its enabling features and gainsay information technology with real, financeable alternatives.

Bruce Katz is the director of the new Nowak Metro Finance Lab at Drexel University, created to assistance cities design new institutions and mechanisms that harness public, individual and civic majuscule for transformative investment.

Photo courtesy chrisinphilly5448 / Flickr

iversonpeartrut1989.blogspot.com

Source: https://thephiladelphiacitizen.org/shift-capital-kensington/

0 Response to "Why Shift Capital may be just what Kensington needs for community regeneration"

Post a Comment